Key markets see selling rates start to rise in February, according to GlobalData

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

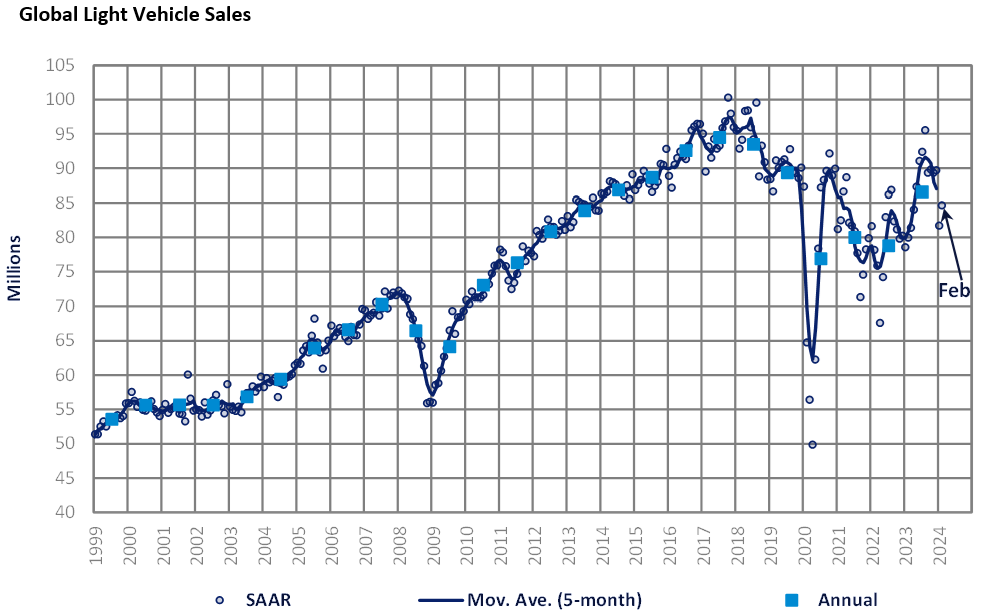

The Global Light Vehicle (LV) selling rate rose to 85 million units/year in February, up from 82 million units/year in January, though still weak compared to the second half of last year. Over 6 million vehicles were sold last month, though the YoY result was down 2.8% YoY primarily because of a contraction in China.

MORE: Global light vehicle sales rate rises in February

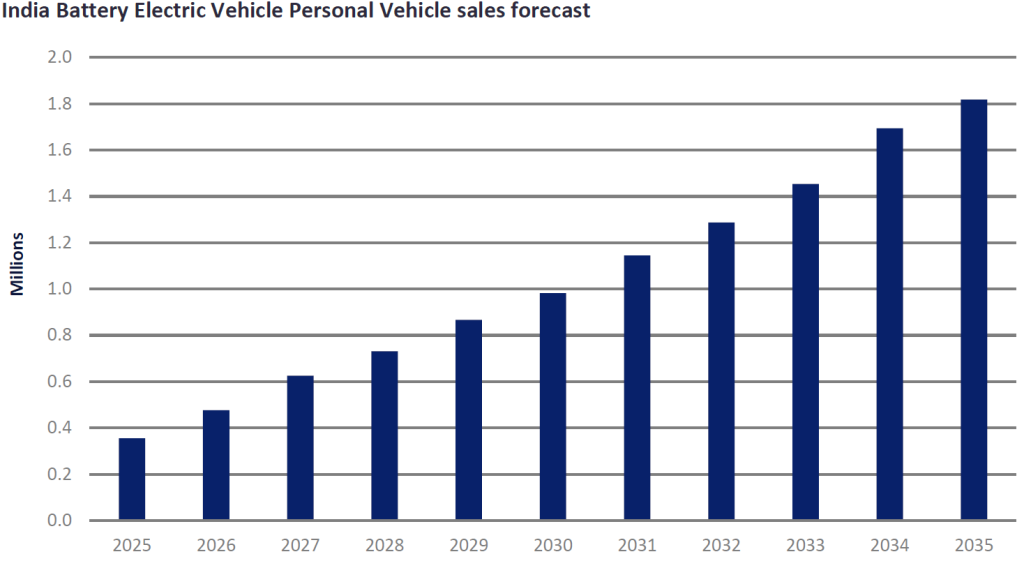

VinFast in India

Vietnamese automaker VinFast is poised to enter the Indian automotive market with a focus on the Battery Electric Vehicle (BEV) segment. However, the success of this strategic initiative is uncertain, given the significant challenges posed by the competitive landscape, the dominance of established players, and the cost-conscious nature of Indian consumers.

The Indian automotive market is extremely competitive and has seen international giants like General Motors and Ford exit after decades of operation. Even Toyota and Volkswagen have struggled to establish a significant presence. This competitive environment presents a formidable challenge for VinFast, a newcomer, to establish its brand and attract the value-seeking Indian consumer.

MORE: Will VinFast’s gamble on India pay off?

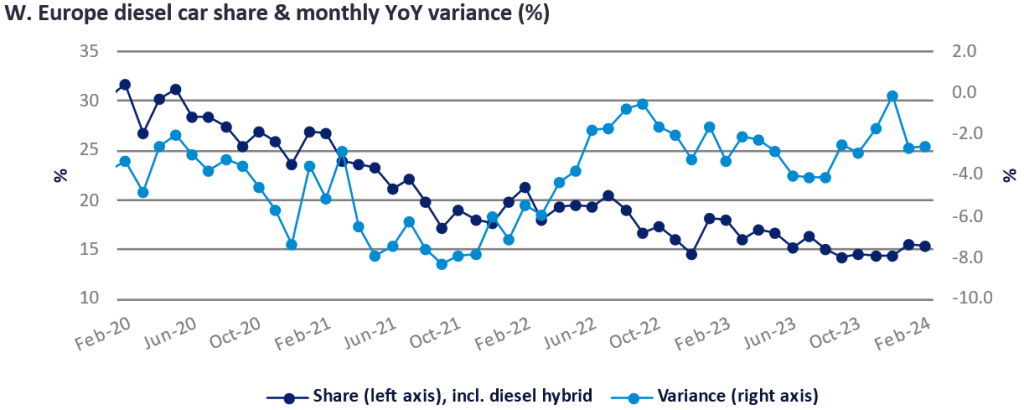

Diesel share in Europe’s car market flatlining

January’s diesel share of new car sales in the region (including diesel hybrids – mostly 48V) is confirmed at 15.5% with February coming in at a very similar, and provisional, 15.4%. The robustness seen over the last 6 months may be connected to a slowdown in demand for BEVs, especially in Germany in the opening months of this year.

MORE: Diesel share of new car sales in Western Europe

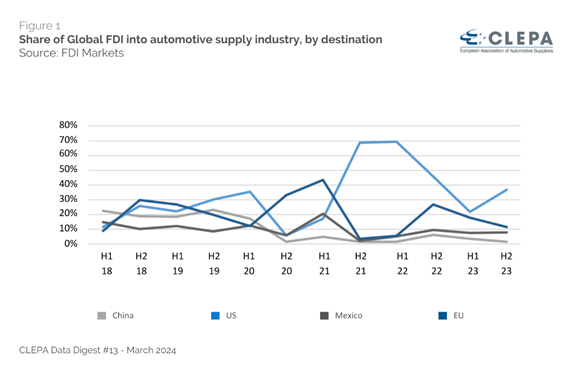

European supplier sector under strain as job losses up, investment down

Europe’s automotive components trade association, CLEPA, says that the EU is losing out to the US in attracting foreign direct investment (FDI) in the global automotive supplier industry.

It says that, regarding FDI, the US has significantly outpaced the EU, attracting three times the amount of FDI over the past two and a half years. This discrepancy in investment, coupled with a higher rate of job cuts, falls notably short of the expectations set at the beginning of the decade, it says.

MORE: European job losses rise, as investments shift abroad – CLEPA