Despite slower-than-expected sales, OEMs and Tier One manufacturers of critical parts for battery electric vehicles (BEVs) should avoid cutting costs by reducing innovation activity and explore ways to flex their IP strategies instead.

The latest figures from the SMMT on new car registrations in the UK show that EV sales are growing strongly overall and sales of BEVs specifically now account for 16.8% of the new car market year to date. However, BEV uptake is still trailing expectations and sales forecasts have been lowered in most major markets.

Car makers in the UK are concerned that they might not be able to comply with the Zero Emission Vehicle (ZEV) Mandate, which requires them to sell an increasing proportion of zero emission vehicles annually, in the run up to a planned ban on the sale of new internal combustion engine (ICE) vehicles in 2035. A similar ban on the sale of new ICE vehicles applies in Europe, where EV volumes from March 2024 have recently been revised down to 2.6% this year.

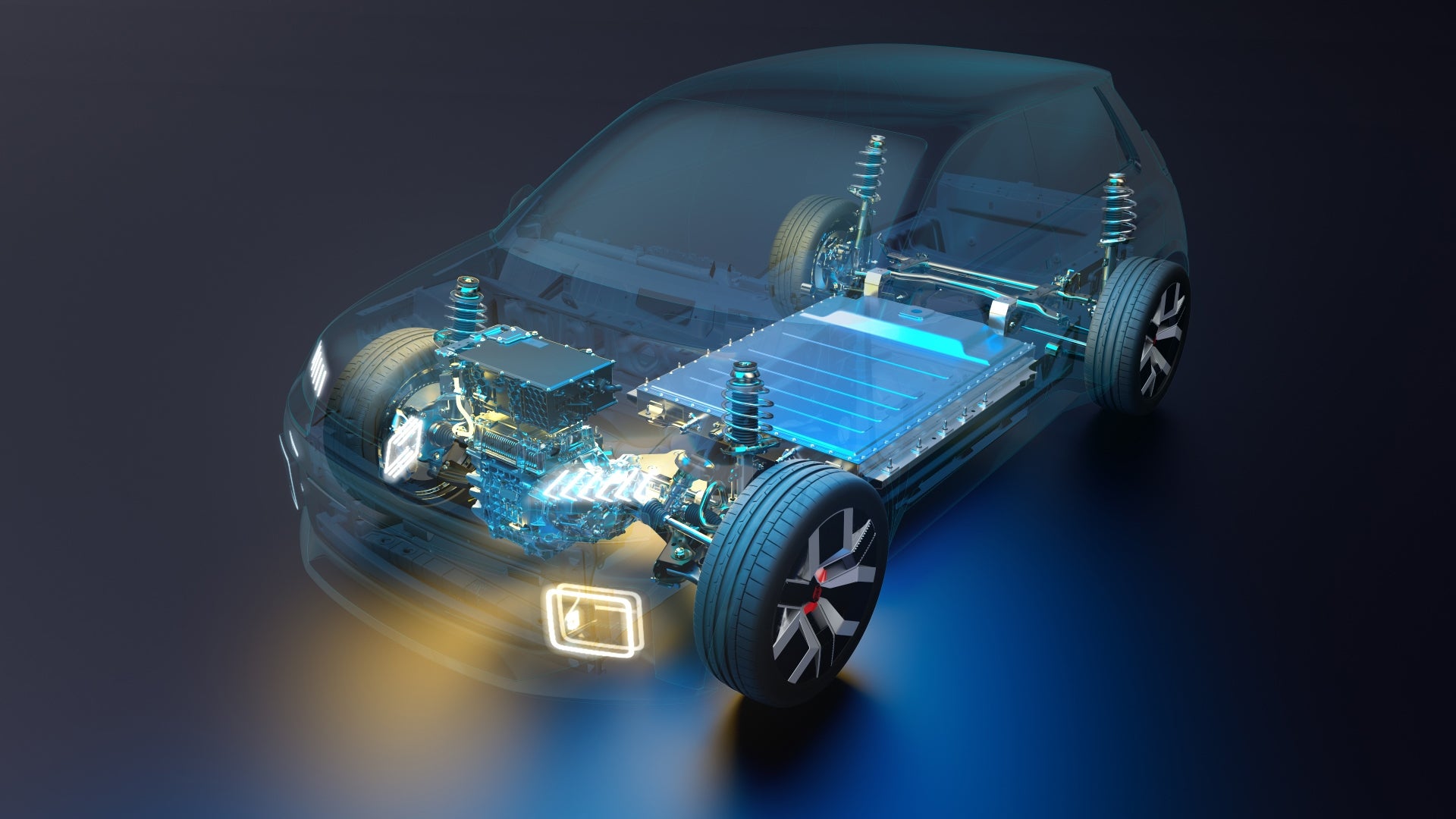

Reasons for the slowdown in the sale of new BEVs are well documented. In addition to economic instability and inflationary cost pressures, uncertainty about the direction of travel in terms of the choice between hydrogen fuel cell EVs (FCEVs) and BEVs is a key factor. For consumers, the slow pace of investment in, and implementation of, new charging infrastructure means that range anxiety hasn’t gone away, and subsidies are likely to be needed to drive demand. There are also increasing concerns regarding the lifespan of the batteries that power the vehicle, in particular their drop in capacity over time.

Whilst residual values of used EVs, particularly newer models, are moving closer to price parity with comparable used ICE vehicles, uncertainty about the used car market for EVs could also be deterring consumers from making the switch.

Having invested heavily upfront in the EV transition, and now experiencing slower sales volumes than expected, some car makers and OEMs are looking to trim costs by reducing budgets. Whilst the development of mainstream EV ranges remains a priority, particularly in view of advancing global competition, there is a danger that R&D investment, particularly in the area of intellectual property protection, could be targeted.

There is a danger that R&D investment, particularly in the area of intellectual property protection, could be targeted.

As intangible assets, the value of patent portfolios is not as visible as other assets, such as end product, but it often holds considerable value, particularly at a time of rapid technological change. Rather than cutting spend on protecting innovations, manufacturers should rethink their strategies and look for ways to streamline their investments.

If the value of IP is in doubt, the industry only needs to look at the commercial success that early movers in the EV market have enjoyed by cross licensing their technologies. The patented technology underpinning Tesla’s innovative battery management system (BMS), which oversees the performance and safety of its battery pack, knows how much energy is stored and how many miles the car will drive for, has been licensed widely to third parties across industry sectors. Similarly, patents targeted to fast-charging technologies, owned by the likes of ABB, Rivian and Lucid Air among others, have the potential to solve a key barrier to EV sales, and as such could hold considerable commercial potential in the future.

With cost pressures building, manufacturers may need to rethink their strategies for protecting R&D investment. Due to the long-term nature of many R&D initiatives, it may be sensible to reduce IP spend in the short term by filing an international patent application or ‘PCT’ to defer any decision about where to seek national protection for up to two and half years. This means new innovations can still be protected, but the more significant costs associated with patent office fees and translations will come much further down the line. A strategic review of existing patent portfolios could also help to identify older patents, which are more costly to renew and could be allowed to lapse if not commercially significant.

The fast pace of technological change in a rapidly maturing market means that a sustained focus on R&D investment in EV technologies is vital, to avoid losing ground to competitors or missing out on an opportunity to invent something that sets a new industry standard. Regardless of whether the market is dominated by FCEVs or BEVs in the future, the technologies that support industry electrification – the electrical hardware – could bring significant commercial rewards, whilst simultaneously providing strong foundations for a thriving EV industry.

Ben Palmer and Diego Black are partners and patent attorneys at European intellectual property firm, Withers & Rogers. They specialise in the automotive and electronics industries.