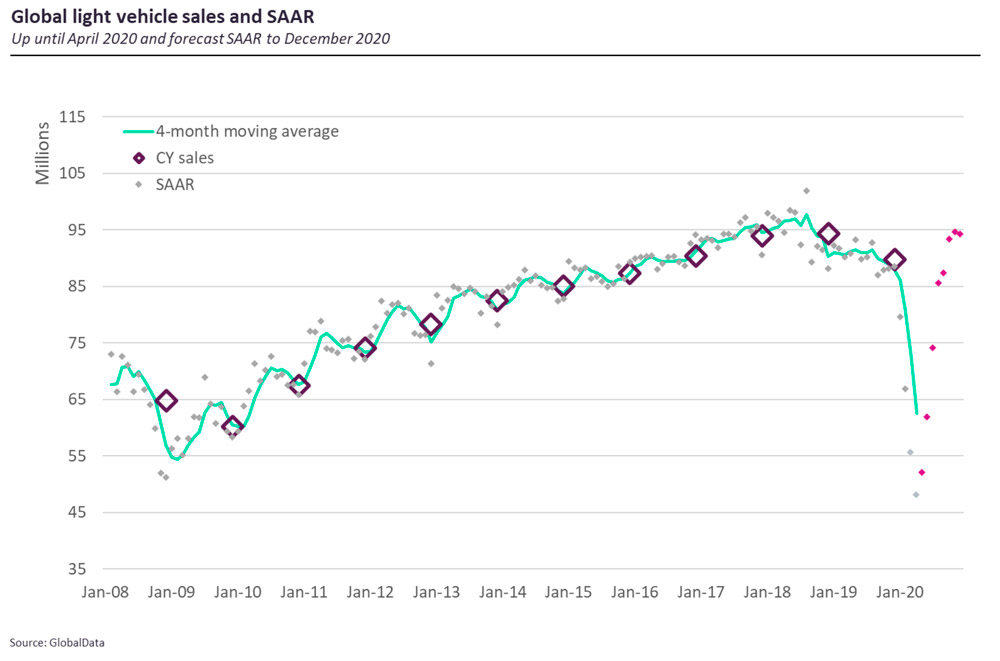

Data compiled by GlobalData shows that global light vehicle sales fell 47.5% in April to 3.8 million from 7.2 million a year ago, providing confirmation of everyone’s worst fears for markets in April.

The worst affected regions were South America, down 78% to just over 80,000 units and Europe down 75.6% to just under 426,000 units.West Europe on its own fell 78.9% to just over 293,000 units.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

April’s results mean that YTD the global market is down a precipitous 32%, a decline nobody would have seen coming just four short months ago.

The SAAR dropped to 48.2 million for the month, below the previous low in our records of December 2008

We believe that April will represent the low-point for the global market – other markets may reach their nadir in May or June – as China bounces back and other high-volume markets begin to open the shutters. Markets that we believe will have to brace for even more humbling results in May include South America and MEA.

Elsewhere in May we believe markets will begin the long climb back and we’ll begin to get more signals on market demand for the rest of the year.

The coming months will reveal the extent of economic scarring, if there’s any pent-up demand or if markets need a kickstart from government-sponsored scrappage schemes. Finally, we’ll also begin to see in emerging markets whether there’s been a fundamental pivot away from public transport and sharing towards more personal car ownership.

GlobalData’s forecast for the year stands at 74 million light vehicles, 17.6% down on 2019’s result. However, the central baked in assumption is that we’ll see concerted government sponsored efforts in the northern hemisphere to kickstart vehicle markets later in the year. With its high economic added value and importance to employment the industry will be seen, once again, as too big to fail.