It now seems certain that revisions to Germany’s government grants for the purchase of a plug-in car will result in the abolition of the plug-in hybrid (PHEV) grant from the start of 2023. At present this is worth a maximum of €6,750. To qualify for this amount, cars need to have a homologated electric-only range of 60km and should have a net list price of no more than €40,000. The grant is made up of €4,500 from the government plus a €2,250 contribution from the carmaker. PHEVs costing between €40,000 and €65,000 can receive a maximum grant of €5,625.

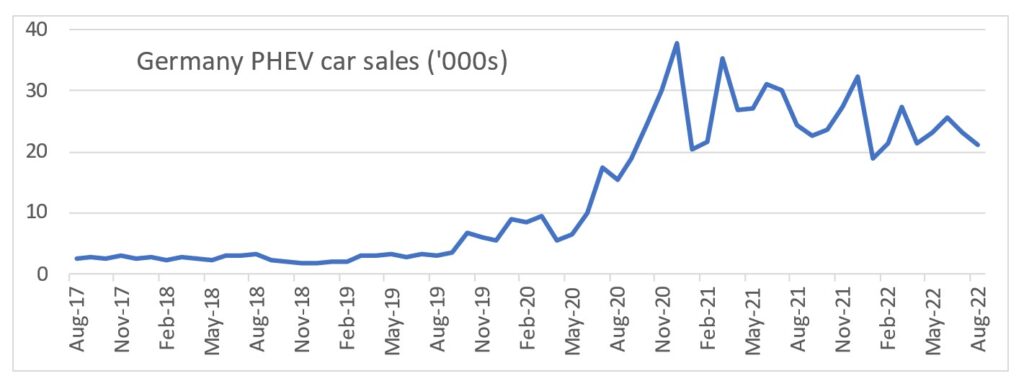

This allowance, along with an even more valuable BEV grant, was part of a significantly boosted support package introduced at the onset of the COVID-19 pandemic as a measure to both maintain car demand and skew it towards environmentally friendly vehicles. The resulting dramatic shift in PHEV demand can be seen in the chart below.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The number of PHEV models available on the German market has steadily grown from an average of 25 in the years 2017 to 2019, to 52 in 2020 and reached the figure of 80 in 2021 which is the figure today. This represents a huge investment in technology for the sector with the German brands being overweight on the share of total sales. In 2021 they accounted for 60% of all PHEVs sold in the country, at 182,000 units. PHEV sales in Germany, driven by the high mix of premium vehicles and the attractive incentives, made up one-third of the million PHEV sales that took place Europe-wide in 2021.

So not only is the German PHEV segment particularly important to German brands, but it is also fundamental to developing critical mass for this technology across the whole region. Were it to collapse, the rules of the game would change, and not only would investment in new PHEV models decline (or even stop), but existing models could see their lifecycle shortened as sales volumes fall below economic levels.

Supported by incentives, focused on the premium end of the market, and able to achieve good CO2 ratings, PHEVs have fallen into the tranche of vehicles that have tended to be prioritised during the semiconductor chip crisis as they commanded strong price premia and returned good profits for carmakers while helping keep down average emissions. But as normality gradually returns to the component supply chain and the inexorable shift to BEV-only platforms continues, PHEVs will inevitably be squeezed. That they have a transitory nature has always been the view of LMC, and our Europe-wide PHEV forecast indicates that PHEV demand is at, or close to, peak share and will slowly decline over time, eventually becoming redundant or being forced out of existence by ZEV regulation from 2030 onward, depending on the market concerned.

Germany isn’t the only market to reduce its support for PHEVs and focus on zero-emission vehicles. The UK did the same several years ago, as did Ireland from the start of this year. Elsewhere, PHEV grants tend to be significantly smaller than those available for BEVs and are generally seen as low-hanging fruit as governments look to roll back expenditure on support for vehicles fitted with plug-in technologies as they become commonplace.

So, we’ve now trimmed our 2023 Germany PHEV forecast for the latest electrification update (by an initial 20k units) and have set a somewhat steeper decline curve for PHEVs across Europe. This isn’t just because the biggest market for PHEVs is changing the rules, but also because manufacturing price pressure on PHEVs and BEVs is only going in one direction as battery material costs escalate. This is pertinent, as gone are the days when PHEV batteries were a fraction of the size of BEV batteries. To fulfil electric range requirements, they have had to be fitted with batteries up to 30kWh in capacity. Not so long ago this might be seen as a typical BEV battery size. The increased production costs for PHEVs only make them more susceptible to any downward shift in the incentive framework that currently helps to support their market position.

Members of the German government arguing in favour of the PHEV grant removal claim that PHEVs are established in the market and no longer need the grant. We’re not convinced about that. The best-selling PHEV model in 2021 in Germany was Ford’s Kuga. The Kuga has a list price starting from €43,750 depending on trim level. The PHEV grant of up to €5,625 represents almost 13% of that figure and removing it must, in our view, have a significant impact on the addressable audience for the Kuga PHEV. For large premium vehicles, the grant is less important as a share of the list price, but much of the market lies in the €40,000 to €65,000 range. Even a €65,000 vehicle will be facing a 9% price increase when the grant is removed.

PHEVs continue to have a part to play in Europe’s roadmap to zero-emission vehicle sales, but one that looks likely to shrink from next year.

Al Bedwell