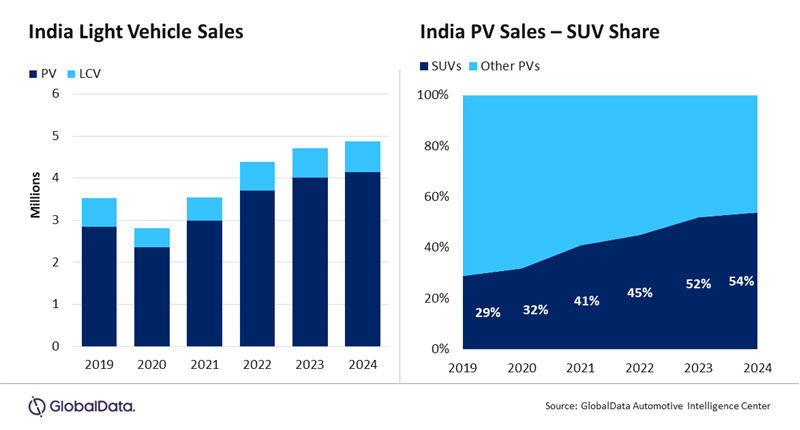

India’s light vehicles (LV) market is on the cusp of a record-breaking year, with a confluence of economic, political, and market factors aligning to drive growth. Robust economic expansion, the government’s fiscal stimulus, sustained demand for SUVs, and new model activity are expected to drive wholesales to a record-high of 4.9 million vehicles in 2024, forecasts GlobalData, a leading data and analytics company.

Ammar Master, Director (South Asia), Automotive at GlobalData, comments: “The Indian market already made a solid start in 2024, as LV wholesales in January were up by 12% year-on-year (YoY), even though year-ago sales were also strong. The preliminary data for February further suggest that sales rose by around 9% YoY, driven by the newly launched models, such as the Hyundai Creta facelift for example.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“The government’s fiscal stimulus, timed with the upcoming general elections, is expected to further spur job and income growth, thereby enhancing vehicle demand in the next few months.”

SUVs remain the prime driver behind the healthy volumes in India. In 2023, SUV sales witnessed a remarkable 24% YoY growth, reaching 2 million units and accounting for more than half of the country’s passenger vehicle (PV) volume. This surge was driven by automakers’ efforts to meet consumer preferences through the introduction of new SUV offerings that cater to various market segments.

Master continues: “SUVs are again behind the robust performance at the start of this year. Sales in January gained by 27% month-on-month (MoM) and 28% YoY, which were fuelled by the launch of the updated versions of the popular Hyundai Creta and Kia Sonet.

“Looking ahead, GlobalData forecasts SUV sales at 2.2 million units (+9% YoY). The sustained demand for SUVs, coupled with the rollout of new models – including facelifts and additional variants – will continue to drive sales.”

Despite entering the SUV market relatively late, market leader Maruti Suzuki India – which comprises about 40% of India’s PV sales – has also established its footprint in this fast-growing segment by swiftly expanding its model lineup with competitive offerings. The company has successfully captured the market’s attention with the second-generation Maruti-Suzuki Brezza, the Suzuki Grand Vitara, and the introduction of the Suzuki Fronx.

These models have not only resonated with consumers but have also allowed Maruti Suzuki to nearly double its SUV sales in 2023. Moreover, GlobalData predicts that Maruti Suzuki’s SUV sales will account for 31% of its PV volume in 2024, up from 28% in the previous year.

Master concludes: “It is always a risk to write off Maruti Suzuki. From SUV sales of 245,000 units in 2018, its sales surged to 433,000 units last year. This robust growth follows a succession of new model introductions, all of which have been well received by consumers. GlobalData anticipates Maruti Suzuki to further solidify its leadership position in the SUV segment this year and increase the sales margin over Mahindra.”